Accounts Receivable Software

Support the Office of the CFO with automation and AI assistance designed to lower DSO, enhance cash forecasting and improve working capital.

Revitalise your accounts receivable strategy & performance

Ready to accelerate cash collection and revenue recognition? Esker’s Accounts Receivable automation software combines the power of Esker Synergy AI and intuitive collaboration tools to unite every invoice-to-cash (I2C) process and improve the efficiency of every user.

Esker’s Accounts Receivable software suite:

Credit Management

Secure revenue with optimised credit approval and risk monitoring.

Invoice Delivery

Ensure global compliance while automating the delivery of invoices

Payment

Increase your chances of getting paid with online payment capabilities.

Cash Application

Allocate payments fast and accurately with AI-powered automation.

Deductions Management

Use AI assistance to quickly resolve disputes and curtail short payments.

Collections Management

Prioritise tasks with AI-driven predictions and risk analysis to collect cash faster.

Raising the bar on AR outcomes

From DSO reduction and operational savings to higher talent retention and faster invoice processing speeds, Esker’s Accounts Receivable solution suite is used by companies all over the world to elevate their AR outcomes.

“Thanks to esker, we have been able to automate our AR process. E-invoicing is one of the areas where we are walking the talk, as we spur our clients on in embracing digital technology and keeping pace with changing customer expectations.”

Artificial intelligence

Enhance every cash collection action & interaction with AI

At Esker, we think the best AI is that which benefits everyone. That’s why Esker Synergy acts behind the scenes to empower every user while improving the end-to-end CX. Whether it’s facilitating decisions via intelligent suggestions, quickly routing and extracting data from all your AR documents, or providing you with an accurate forecast of incoming cash, Esker Synergy enhances the automation of your I2C process so you can achieve your end goal — more efficient cash collection management.

Analyst accolades

See what the experts say

As a global cloud offering designed to optimise the invoice-to-cash process, Esker’s Accounts Receivable solution suite has been recognised by multiple leading analyst firms over the years. Most recently, these include:

Named a Leader in 2024 Gartner® Magic Quadrant™ for Invoice-to-Cash Applications and a Strong Performer in 2024 Gartner® Voice of the Customer for Invoice-to-Cash Applications.

Esker listed as a Digital World Class provider in the Customer-to-Cash Receivables Hackett Excelleration Matrix™️

Esker named a Leader in IDC MarketScape Accounts Receivable Automation Applications for Small/Midmarket and a Major Player in IDC MarketScape Accounts Receivable Automation Applications for Enterprise 2024 Vendor Assessments.

Manage payment collections with

ease through active collaboration

Getting paid in a timely manner requires a collective effort and the right technology in place to minimise tensions between people and departments. Regardless of your organisation's configuration, Esker's solutions natively integrate with each other and offer collaborative tools that facilitate the interactions between team members within the I2C process and outside the AR department, as well as improving the visibility into customers’ receivables situation:

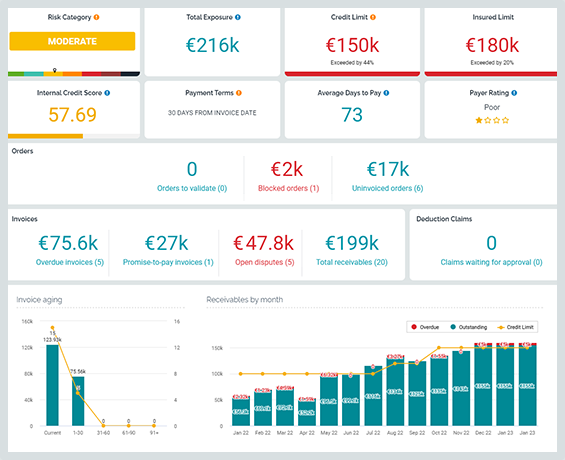

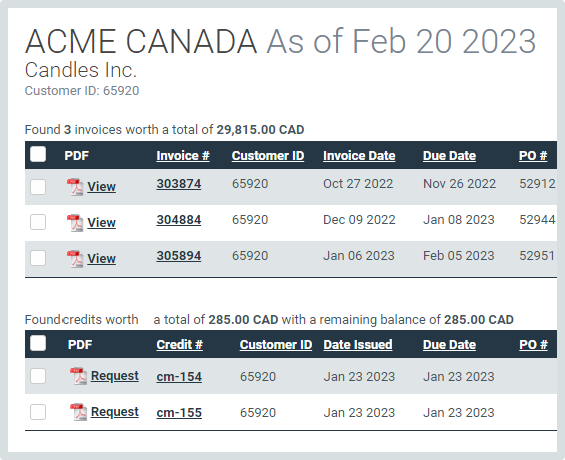

Centralised information & real-time data

Data is instantaneously available in the AR solution suite (promise-to-pay, online payment, allocated payment, invoice delivery status, etc.).

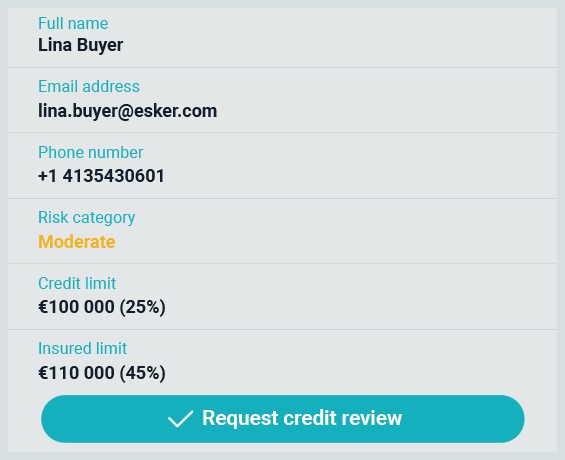

Customer Management

A 360-degree view on customers situation:

- Credit KPIs: Credit limit, risk exposure, risk category, etc.

- Business situation: Blocked & undelivered orders, invoices, pending claims, etc.

- Documents: Purchase orders, invoices, remittances, credit applications, contracts, etc.

Unlimited user access

All accounts receivable automation software solutions are based on unlimited user access so anyone involved in the I2C process can access data anytime and get the visibility they need.

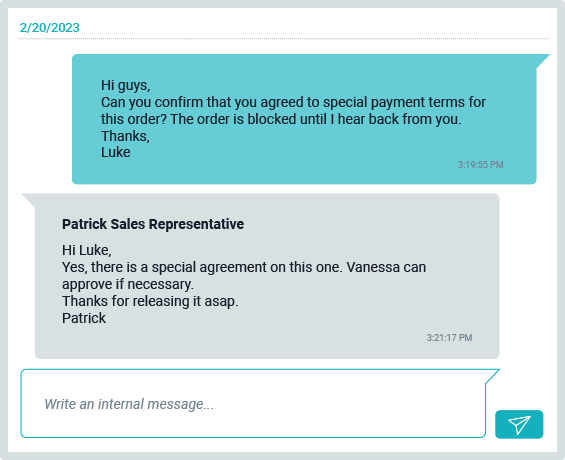

Internal conversations

Start a conversation with one or several coworkers from any process (e-invoicing, credit review, allocation form, claim approval, etc.) to clarify a situation.

External conversations

Interact quickly with the customer to clarify an allocation or request a claim, supporting document or payment.

Task & dispute management

Create and assign tasks from disputed invoices to accelerate the dispute resolution process.

Cross-solutions business scenario

Easily address the most common business scenario to accelerate resolution (creating a claim from a short payment, requesting a collection call to release a block order, etc.).

Automated approval workflows

Create workflows rules to secure your decisions and automate the approval process when necessary (credit reviews, deductions validation, etc), as per your credit policy.

Esker Connectivity Suite

Integrates with any ERP or business application.

Connections to customers & AP portals

Esker supports 300+ connections with the most common AP portals (Coupa, Ariba, etc.) as well as customer portals to post invoices and retrieve AR information.

Customer portal

Esker’s AR solution suite is equipped with a customer and payment portal to facilitate customer relationships. Your customers can retrieve their invoices, and account statements with full autonomy and even pay online in 40+ countries worldwide.

Facilitating collaboration between Sales and Finance teams is crucial. That’s why Esker has equipped our AR solution suite with tools to make it much easier:

Mobile app

Esker AnywhereTM allows salespeople to request a credit check or review their customer situation at a glance anytime, anywhere so that they can make the right decision for the business.

API integration with Salesforce

By sharing collection notes instantaneously with the sales team’s main tool, you ensure your team is up-to-date with the customers’ receivables situations and the latest collections activity and notes, resulting in better business decisions and customer relationships.

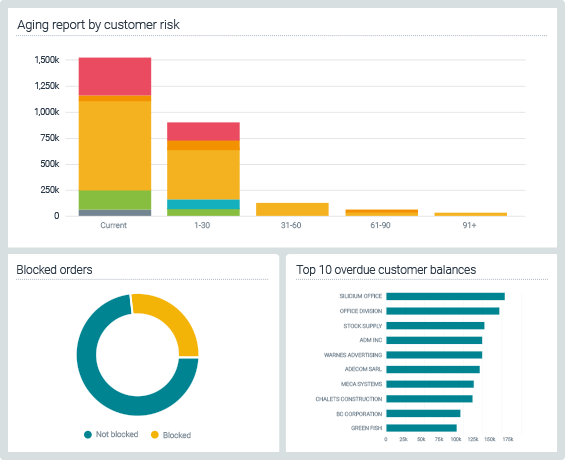

Elevate your decision making

with data-driven insights

In a constantly changing world, AR is no exception — AR leaders need accurate and relevant data to monitor performance, adjust strategies and goals, and make the best possible business decisions.

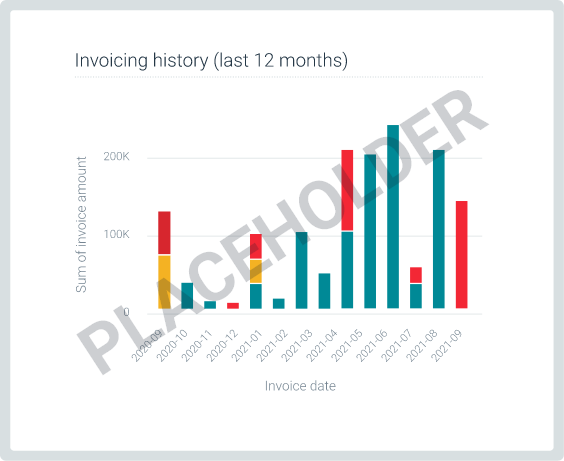

Esker’s Accounts Receivable automation software and solution suite is equipped with customisable dashboards and KPIs so you can keep an eye on key metrics (DSO, DDO, CEI, collections forecast, disputes, root-cause analysis, etc.) and adjust decisions accordingly. You can even build your own reports and share the “cash culture” throughout the organisation.

See what our customers say on Gartner Peer Insights

Featured Content

5 Strategies to Accelerate Your AR Processes and Get Paid Faster

Submitted by Michelle Foong on Wed, 02/28/2024 - 22:13English, SingapourResource Type:Pinned to Top:NoExternal URL:https://content.esker.com.sg/AS-AR-WSEM_Goldcast-5_Strategies_to_Accelerate_Your_AR-February2024_Landing-Page--On-Demand-Website.htmlBusiness Need:Preview Image: Culture Cash Episode:

Culture Cash Episode:- Log in to post comments

The Accounts Receivable AI Playbook

Submitted by Michelle Foong on Wed, 11/29/2023 - 21:37English, SingapourResource Type:Description:Elevating AR performance with the ultimate team-friendly technologyPinned to Top:NoExternal URL:https://content.esker.com.sg/AS-AR-EB-AI_Playbook_AR-Nov2023.htmlBusiness Need:Preview Image: Culture Cash Episode:

Culture Cash Episode:- Log in to post comments

7 Tips for Effectively Managing Accounts Receivable

Submitted by Michelle Foong on Mon, 06/01/2020 - 22:04English, SingapourResource Type:Description:During times of significant disruption and uncertainty, it’s essential for organisations to maintain business process efficiency as well as communication with customers and team members. Here are seven tips to help you adapt your collections strategy, continue collecting cash, take care of your customers, empower your team, and come out on top (without being impacted too severely).Pinned to Top:NoExternal URL:https://content.esker.com.sg/AS-7Tips_Effectively_Managing_Accounts_Receivable_In_Challenging_Times.htmlBusiness Need:Preview Image: Culture Cash Episode:

Culture Cash Episode:- Log in to post comments

Solution walkthrough: What's in Esker Accounts Receivable Solution

Submitted by Michelle Foong on Tue, 07/25/2023 - 21:19English, SingapourResource Type:Pinned to Top:NoExternal URL:https://videos.esker.com/watch/r4cDJ9CX3BYuMr719FRfqi?Business Need:Preview Image:

- Log in to post comments

Frequently Asked Questions About Accounts Receivable Software

We’ve compiled answers to some of the most commonly asked questions about Esker’s Accounts Receivable (AR) automation solution and software. Have a question you can’t find the answer to? Reach out by clicking the “Get in Touch” button below.

Do I have to automate my entire Accounts Receivable process?

Only if you want it to! The beauty of our Accounts Receivable automation software is in its flexibility. Our à la carte solution model allows users to choose if they automate one, some or all of the areas within their credit-to-cash process — from credit management and invoice delivery to collections, payment and even the cash application process.

What advantages will I see with an Accounts Receivable software solution?

Businesses using Accounts Receivable automation software solutions should expect to see a more productive staff (thanks to fewer manual, admin-heavy tasks), optimised working capital (due to reduced costs, faster payments and secured revenue), enhanced visibility (via dashboards that provide detail metrics into AR performances, customer credit and more) and, last but not least, an improved customer experience that can ultimately lead to more business opportunities.

Does Accounts Receivable software integrate with all ERPs?

Yes! To date, Esker has over 70 unique ERP or home-grown solutions. Esker’s Accounts Receivable software solution integrates with any ERP system or business application. Once the customer invoice is validated in the ERP, it’s quickly and securely transmitted to Esker to be processed. Our Accounts Receivable software can also synchronise customer information, payment status, and open AR files.

Can Esker’s Accounts Receivable software handle global companies?

Absolutely! Automated Accounts Receivable software is designed for global organisations thanks to the support of multi-languages, multi-sites, multi-currencies, worldwide payment coverage and global compliance. Moreover, the cloud-based nature of the solution enables different teams to collaborate more effectively while giving executives the visibility they need at every level of the organisation.

Esker Singapore has worked with leaders in various industries such as:

Fujifilm - leader in office productivity solutions.

With Fujifilm, Esker’s accounts receivable software helped to digitise their traditional invoice system with the aim of speeding up the invoice turnaround time. Invoice processing time was effectively reduced from 9 working days to just 3 working days, aside from that, Fujifilm was also able to reduce their carbon footprint by relying less on paper. Find out more about the success story here!

International SOS - leader in international health and security risk management.

Esker’s capabilities introduced full fledged solutions that digitised Accounts Payable, Invoice Delivery, Collections Management and Cash Applicable - the automation overhaul helped to eliminate bottlenecks from International SOS’s invoice reception and cash application process. Our solutions were seamlessly integrated within International SOS’s cloud database, ERP and billing systems - read more about the case study here.

What is Accounts Receivable automation software?

The Accounts Receivable automation software procedure can be complex and time-consuming, with many steps that must be completed to ensure timely and accurate payment. Powered by Artificial Intelligence (AI) technology, a comprehensive Accounts Receivable automation software can come in handy to ensure that your process is working optimally and delivering the results you need. Accounts Receivable automation software allows your business to receive payments faster, manage collections more effectively, and improve the overall customer service. An automated Accounts Receivable process can ultimately free up time, provide visibility over cash flow and reduce DSO for finance departments to focus on more strategic initiatives that will help grow the business.

Can the Accounts Receivable software be tailored to meet specific needs of different organisations?

Yes, Esker's Accounts Receivable software is meticulously designed to provide flexibility and scalability, ensuring it can be tailored to suit the distinct requirements of different organisations. This Accounts Receivable payment software automates the entire invoice-to-cash process, optimising each step and enhancing overall efficiency, visibility, and collaboration. Its robust design makes it an indispensable tool for AR leaders in organisations of all sizes and industries, enabling them to expedite cash collection and revenue recognition processes effectively.

What level of customer support and training is offered for using the Accounts Receivable software?

Esker understands the importance of excellent customer support and training in utilising our automated Accounts Receivable software. This is why we offer comprehensive assistance to our users, with a dedicated support team ready to address any inquiries or difficulties they may encounter. Moreover, we provide training resources that empower users to maximise the software's potential. From initial onboarding to ongoing learning, our goal is to instil confidence and competence in every user's ability to utilise the software effectively.

How does the AI technology enhance the automation of the Accounts Receivable process?

Esker Synergy, our cutting-edge AI technology, plays a pivotal role in revolutionising the automation of the Accounts Receivable process. Designed to empower users and elevate the overall customer experience, Esker Synergy operates seamlessly in the background. By harnessing the power of artificial intelligence within our accounts receivable automation software, Esker Synergy optimises every aspect and engagement that influences payment collection. It automates repetitive tasks, expedites invoice processing, and even offers predictive insights, all contributing to a remarkably streamlined and efficient Accounts Receivable process.

Frequently Asked Questions About Accounts Receivable Automation Software in Singapore

What are the common account receivable challenges faced by Singaporean companies?

Singaporean companies often face AR challenges such as delayed payments, inefficient manual processes, and maintaining customer relationships while ensuring timely cash flow, all of which can significantly impact their financial health.

How does Esker’s AR automation software benefit companies of all sizes?

Esker's accounts receivable automation software offers flexibility and scalability, automating the invoice-to-cash process to improve efficiency, visibility, and collaboration for organisations of any size. It enables faster cash collection and revenue recognition, making it essential for accounts receivable leaders.

How does accounts receivable software help keep a steady cash flow for face paced companies like in Singapore?

Accounts receivable software streamlines invoice processing and payment collections, crucial for fast-paced Singaporean companies. By automating these processes, businesses maintain a steady cash flow, reduce days sales outstanding, and enhance financial stability.

How do I introduce accounts receivable automation software into my company’s current workflow?

Introducing accounts receivable automation involves assessing current processes, selecting a software that integrates seamlessly with your existing systems, and providing comprehensive training to ensure smooth adoption and maximise the benefits of automation.

Does the AR software support multi-currency transactions?

Yes, Esker’s accounts receivable automation software supports multi-currency transactions, accommodating the diverse and global needs of businesses operating in Singapore, facilitating accurate and efficient processing of international payments.

Is the software capable of automating payment reminders and collections?

Yes, the automated accounts receivable software efficiently automates payment reminders and collections processes, reducing the administrative burden on your team, improving payment times, and supporting a proactive approach to managing receivables.

How does the software ensure data security and compliance with Singapore's PDPA?

Esker's accounts receivable automation software is designed with robust security measures. Esker has achieved the internationally recognised ISO 27001:2013 certification for its Information Security Management System (ISMS) of on-demand services, certifying that our company’s ISMS protects its data and that of its customers.

Frequently Asked Questions About Accounts Receivable Automation Software in Malaysia

What is the primary problem associated with accounts receivable in Malaysia?

The primary issue with accounts receivable in Malaysia includes delayed payments due to inefficient invoicing processes. This leads to disrupted cash flow, affecting the company's ability to invest, pay debts, and manage daily operations efficiently.

What are the early signs of bad debt related to poor account receivables within a company?

Early signs of bad debt include increasing days sales outstanding, frequent late payments, and a growing number of disputes over invoices. These indicators suggest inefficiencies in the account receivables process, potentially leading to financial instability.

How can a Malaysian company reduce the risk of bad account receivable?

A Malaysian company can reduce the risk by automating its accounts receivable processes, employing credit management strategies, regularly reviewing customer creditworthiness, and maintaining clear communication with clients about payment expectations and terms.

What are the benefits of Esker Malaysia’s accounts receivable automation software?

Esker Malaysia’s accounts receivable automation software solution enhances efficiency, visibility, and collaboration in the invoice-to-cash process. It speeds up cash collection and revenue recognition, providing indispensable tools for companies to manage their receivables effectively.

Can I customise the account receivable automation for my small business?

Yes, Esker's accounts receivable automation software is designed to be flexible and scalable, allowing customization to fit the unique needs of your small business. This ensures that you can optimise your accounts receivable processes, regardless of your company's size.

Our partners

- Coming Soon