Cash Application Software

Accelerate payment processing with AI-powered automation

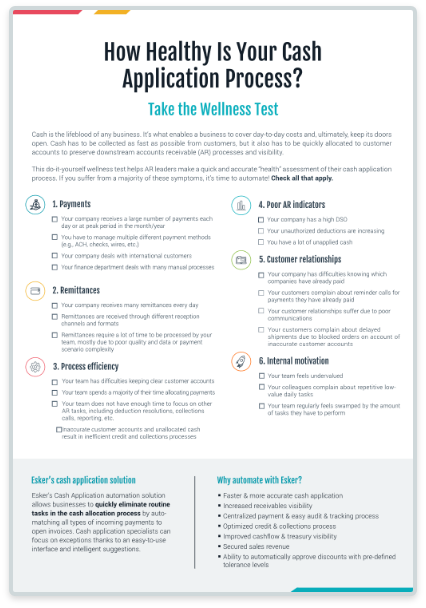

WHY AUTOMATE CASH ALLOCATION WITH ESKER?

Esker automates the manually intensive process of matching payments received from all incoming payment information sources so your team can focus on higher value tasks and control cashflow in real time.

Apply cash faster & secure revenue

Accelerate cash allocation processing and deductions identification with AI-powered software.

Improve credit & collections efficiency

Free up your team thanks to faster allocation and cleared customer accounts.

Enhance visibility on cash inflows

Benefit from real-time visibility of your cash inflows through dashboards and reporting.

Make life easier for every stakeholder

Improve communication with customers, resolve disputes quicker, and boost your team morale and productivity.

Manage all your payment information — all in one place

Tired of spending time collecting documents from different locations and manually extracting data from them? Esker Cash Application allows users to centralise all their payment information, enabling:

Simplified remittance management

Retrieve remittances through:

- Customer portals with RPA technology

- Emails with intelligent routing powered by Esker Synergy AI, which automatically extracts & routes remittances received by email to Esker Cash Application

- Scanning & routing paper remittances by email, SFTP or Esker Loader

Fewer bottlenecks & errors

Esker Synergy AI combines a set of advanced AI technologies to reach maximum remittance recognition rate, significantly speeding up cash allocation.

- AI first-time recognition: Esker Synergy automatically extracts data from complex remittance advices, even when seen for the first time. Using deep learning & NLP, it creates a neural network that performs human-like data interpretation.

- Machine learning: Esker Synergy auto-learns from user corrections/validations, improving its performance over time.

- Teaching: Trained users tell Esker Synergy how to recognise specific recurring remittance layouts.

“We needed a good communications system between both the Collections and Cash Allocation teams to ensure an efficient process: the Cash Allocation team requires insights from the Collections team, as they are the ones with the customer contact and know which invoices are going to be paid. ”

Payment matching made simple

Allocate payment from multiple sources

- From bank (bank statement, lockbox file)

- From customers (check, remittance advice)

- From external providers (e-commerce, customer portal)

Automate payment allocation using 2- or 3-way matching

Esker Synergy can extract data from remittance advices and payment files to automatically find the right match with open invoices or credits. The system auto-learns from users and improves its performance over time.

Configurable rules

Set up rules to automate specific cases and say goodbye to time-consuming exceptions (set up early payment discounts or underpayments threshold, manage withheld tax amounts, etc.).

Resolve complex allocations from a collaborative user interface

Esker Cash Application provides your team with an all-in-one interface to handle everyday exceptions easily, with full visibility into available data, help messages, and suggestions and collaborative tools.

All information is in a single interface, divided into two screens, to get full visibility to your team when allocating cash.

Allocation part (left screen)

- Work in an interface made to simplify exception handling, with options such as: recycling payments and prepayments, posting adjustment to G/L or customer accounts, attaching documents, and taking bulk actions to save time.

Information part (right screen)

- Keep an eye on remittance advice or any other document image while working on it.

Advanced search

- Many filters are available to quickly find what you’re looking for (invoice, payer, etc.).

Smart suggestions

- If multiple allocations are available, smart suggestions powered by Esker Synergy facilitates decision-making for your team. Machine learning is used to improve the accuracy of these suggestions over time.

Help messages

- Aids the user in understanding why a manual intervention is needed.

Tooltips & warnings

- Informs users of disputed amounts, invoice validity date, deduction validity and more.

Internal conversations

- Interact with your coworkers directly from the allocation form, breaking silos in your company while keeping track of all information along the workflow/process.

External conversations

- Start a conversation with a customer using message templates, or process documents from messages to save time.

Improve visibility into cash inflows & allocation performance

Visualise data at-a-glance

All payment information is available in one fully customisable dashboard. Give more visibility to your team and improve data-driven decision-making.

Focus on KPIs that matter

Improve performance monitoring with real-time KPIs on auto-allocated payments, allocation by user and unapplied cash.

Track remittance advice automation trend

Keep an eye on the volume of remittances automated month by month, the number of fields auto-populated, etc., while providing clarity on where the automation rate could be improved.

Create, customise & share insightful reports

Benefit from standard reports on:

- Allocated payments (by user, by payment type, etc.)

- Unapplied cash

- Payment allocation details

- Make your own customised reports if needed

Seamless ERP integration

Real-time payment

reconciliation for SAP customersBenefit from our pre-built SAP connector for Esker Cash Application, providing a fast, flexible and secure allocation for all customer payments.

Esker Rest API

We offer communication through web services, for a modern and reliable connection.

Output reconciliation file

With all reconciled payments can be extracted and picked up by the customer to clear the accounts in their ERP.

FREQUENTLY ASKED QUESTIONS ABOUT AUTO CASH APPLICATION SOFTWARE

What is auto cash application?

Auto cash application is a process enabled by software that automatically matches incoming payments to the corresponding invoices. This technology streamlines the reconciliation process, reduces manual workload, and enhances the accuracy of accounts receivable management.

What is the benefit of investing in auto allocation software?

Investing in auto cash application software offers significant benefits, including improved operational efficiency, faster payment reconciliation, and reduced manual errors. It frees up Accounts Receivable teams to focus on strategic tasks, ultimately leading to better cash flow management and financial health for the company.

How do you automate the cash application process?

The cash application process is the final step in the Accounts Receivable cycle. It ensures that all customer payments are properly applied to the correct invoices. This can be done manually by a company's accounting department – with employees looking at each payment and applying it to the corresponding invoice – or automatically using software designed for this purpose. With auto cash application, the payments are matched up to the invoices electronically, eliminating the need for manual processing. This not only saves time, but also reduces the chance of human error. Esker’s Accounts Receivable software offers a smart way to increase efficiency and boost your business’ financial management.

What advantages will I see with Esker’s Accounts Receivable cash application software?

If you're looking for a way to improve your business's productivity and working capital, Esker’s auto cash application solution may be the solution you're looking for. Our software will essentially transform the way your staff work by automating many of the manual, time-consuming tasks that they currently have to do. This can free up time for them to focus on other tasks that are more important to your business. In addition, our AI-driven software can help to optimise your working capital by reducing costs, speeding up payments and securing revenue. As a result, you can see a more productive and efficient business overall.

Does Esker’s Accounts Receivable cash application software integrate with all ERPs?

Yes! With over 70 unique Enterprise Resource Planning (ERP) or home-grown solutions, Esker provides a best-in-class Accounts Receivable cash application software that helps businesses get paid faster and improve customer relationships. Our software integrates with any ERP system or business application, making it easy to get started. Once an invoice is validated in the ERP, it's quickly and securely transmitted to Esker for processing. From there, our AI-powered software takes over, reading and understanding the invoice data and extracting the key information.

Can Esker’s auto cash application support my global business?

Yes, it can! Designed to meet the needs of global organisations, our software's multi-site capability enables organisations to process invoices and payments in multiple currencies, while the multi-language support ensures that users can interface with the software in their native language. With Esker’s cloud-based software, teams can work together on cash application projects in real-time, no matter where they are located. Esker’s Accounts Receivable cash application solution is also scalable, so it can grow with your organisation as your business expands into new markets.

To further reduce time spent on administrative tasks, you can also explore the possibilities of Esker’s collection management software, accounts payable system and order management platform.

FREQUENTLY ASKED QUESTIONS ABOUT AUTO CASH APPLICATION SOFTWARE IN SINGAPORE

Why should companies in Singapore invest in auto cash application software?

Singaporean companies should invest in auto cash application software to enhance efficiency, accuracy, and speed in managing accounts receivable. This investment not only streamlines financial operations but also significantly boosts a business's cash flow and financial health, enabling more strategic investment and growth opportunities in Singapore's competitive market.

Is Esker Singapore’s auto cash allocation software compatible with other ERP systems?

Yes, it is. Esker Singapore’s auto cash allocation software is designed for compatibility with a wide range of ERP systems. This ensures seamless integration and data exchange, facilitating a unified approach to financial management without disrupting existing operational workflows.

How does auto cash application software handle multiple currencies?

Esker’s auto cash application software manages transactions in multiple currencies by applying accurate exchange rates for timely and precise invoice matching.

Is the software compliant with Singapore’s financial regulations?

Yes, it is. Esker’s auto cash application software incorporates features for audit trails, data security, and reporting standards, aligning with Singapore's rigorous financial governance.

Can Esker’s auto cash software handle the unique payment methods and banking systems in Singapore?

Definitely! Esker’s auto cash application software is specifically designed to accommodate the unique payment methods and banking systems prevalent in Singapore. It offers versatility in processing transactions through various channels, ensuring efficiency and reliability in the local context.

FREQUENTLY ASKED QUESTIONS ABOUT AUTO CASH APPLICATION SOFTWARE IN MALAYSIA

Can Esker Malaysia’s auto cash application software handle Malaysia’s payment methods?

Yes, Esker Malaysia’s auto cash application software is adept at handling a broad spectrum of Malaysia’s payment methods. It's designed to accommodate local payment practices, ensuring efficient and accurate processing of transactions according to local standards.

Does the software comply with Malaysia financial regulations?

Esker’s auto cash application software is fully compliant with Malaysia's financial regulations, ensuring businesses adhere to the country’s legal and financial reporting requirements. It incorporates features for secure data handling, audit trails, and accurate financial reporting.

Can Esker’s auto cash software support GST and SST compliance?

Yes, it can. Esker’s auto cash application software is equipped to support GST and SST compliance, allowing for the accurate calculation, application, and reporting of these taxes in Malaysia. It simplifies tax management within the cash application process, aiding in regulatory compliance.

Does Esker provide customer support for Malaysia?

Yes! Esker offers dedicated customer support to ensure businesses receive timely assistance and guidance. Their support team is knowledgeable about local practices and regulations, providing relevant solutions and troubleshooting for Malaysian users.

Considering the uniqueness of Malaysia payment methods, is there an editor tool within the auto cash application software?

Yes, there is. Esker’s auto cash application software includes an editor tool, allowing users to customise and adapt the system to the unique payment methods and banking formats found in Malaysia. This flexibility ensures that businesses can manage their receivables efficiently, regardless of the payment method used.

Our partners

- Coming Soon