Cash Collection Management Software

Bringing real efficiency to your cash collection process

AR Collection

Made Easy

Struggling to ensure cash is collected on time and in accordance with your collection strategy? Optimise your process with Esker’s AR collection software! Powered by AI-driven payment predictions and recommendations as well as collaborative tools, Esker’s solution ensures improved credit management for AR managers and collection specialists, resulting in:

- Greater efficiency throughout the entire collections process

- Increased visibility of incoming cash & collections performance

- Improved experience for both team members & customers

“If you can’t see disputed amounts, you assume that 100% of your AR is collectable, which is not at all the case. Esker’s Collections Management solution provides that extra level of detail by separating out disputed amounts.”

3 Steps For Faster Cash Collection

The most efficient collection process is adapted to your organisation, customers and unique needs. That’s why Esker’s AR Collection software allows you to configure your own strategy and automate tasks, while further enhancing your strategy with Esker Synergy AI’s predictable insights and suggestions.

Configure your strategy

Do so according to your organisation's needs and customer profiles to ensure compliance with your payment collection policy and adjust it anytime.

- Multiple levels of customisation

- Unlimited collection groups & strategies

- Diversified strategy with multiple collections methods

- Configurable timing to start, repeat or stop actions

Automate & secure your collections management process

Esker’s Cash Collections Management automates low-value collections tasks, freeing up your team to focus on risky customers or higher-value tasks.

- Automated delivery of payment reminders & account receivables

- Prioritised collection calls needed list

- Customisable to-do list

Get a boost from AI!

Esker Synergy AI analyses customer payment behaviour to estimate the risk of payment default and help reprioritise collection efforts accordingly.

- Payment prediction on each invoice

- Customer risk level based on current vs. past payment behaviour

- Reprioritisation of collection calls listing based on risk level & expected payments

Be more decisive with automated cash collection insights

Esker’s Cash Collections Management is designed to give you 100% visibility into your receivables situation so you can make the right decisions for your business quickly and confidently.

Performance dashboard

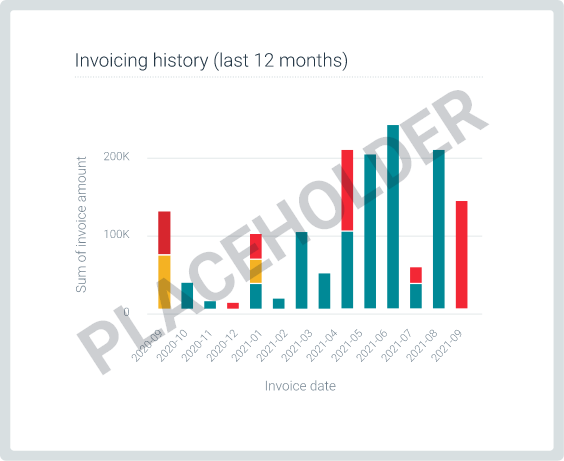

Set goals & keep an eye on real-time collections metrics by entity, collector, sales rep & more (e.g., DSO, CEI, reasons for late payment or dispute).

Collections forecast

Get greater visibility on expected payments within the next 30/60 days with Esker Synergy AI & better adjust your strategies & forecasting.

Projected activities

Assess the impact of your strategy on your team’s effort with a predicted 7-day workload based on payment predictions & additional data.

Customisable reports

Create the reports you need to monitor your ageing balance, follow up on disputes or risky customers & automatically share those reports with stakeholders to extend the cash culture through your organisation.

Collaborative Cash Collection system that benefits everyone

Cash Collection Management can’t rely on the AR team’s shoulders alone. That’s why it’s critical to facilitate interactions between team members, customers, other departments and the IT ecosystem (CRM, ERP, third-party applications, etc.). Esker’s AR Collections software supports such collaboration and keeps the AR department connected internally and externally thanks to:

CRM-like solution

Centralise all post-sale information into a single place, share internal notes, etc.

Advanced messaging

Quickly process & reply to common customer requests thanks to advanced messaging options supported by natural language processing (NLP).

Customer portal

Ease communication with customers and provide them with the documents and information needed (invoices, supporting documents, account statements) + online payment facilities.

API integration with Salesforce

By sharing collection notes instantaneously with the sales team’s main tool, it ensures your team is up-to-date with customers’ receivables situations and the latest collections activity and notes. As a result, it improves business decisions and customer relationships.

Task & workflows

Facilitate & speed up disputes & invoice-related issues resolution.

Optimise your debt management with esker integrated suite

Esker offers a comprehensive Accounts Receivable software that automates and connects every step of the invoice-to-cash process. By instantaneously applying additional insights from other Esker solutions, your cash collections process benefits from even greater efficiency.

- Utilise credit risk management to drive your collections strategy (by leveraging Esker Credit Management)

- Get real-time updates when a payment comes in (by leveraging Esker’s Auto Cash Application)

- Ensure invoices have been received before contacting a customer (by leveraging Esker Invoice Delivery)

Featured Content

5 Strategies to achieve a best-in-class credit & collections process

Submitted by Michelle Foong on Wed, 07/14/2021 - 21:55English, SingapourResource Type:Pinned to Top:NoExternal URL:https://content.esker.com.sg/AS-5-strategies-for-achieving-best-in-class-credit-collections-process.htmlBusiness Need:Preview Image: Culture Cash Episode:

Culture Cash Episode:- Log in to post comments

3 Quick Steps to Inject a Sustainable Cash Flow Management Culture Within Your Organisation

Submitted by Michelle Foong on Wed, 08/17/2022 - 23:08English, SingapourResource Type:Pinned to Top:NoExternal URL:https://content.esker.com.sg/AS-3_Quick_Steps_Inject_Sustainable_Cash_Flow.htmlBusiness Need:Preview Image: Culture Cash Episode:

Culture Cash Episode:- Log in to post comments

5 AR KPI You Should Track

Submitted by Michelle Foong on Thu, 12/01/2022 - 11:16English, SingapourResource Type:Description:Want to improve global AR performance?Pinned to Top:NoExternal URL:https://content.esker.com.sg/AS-5-KPI-AR-Should-Track.htmlBusiness Need:Preview Image: Culture Cash Episode:

Culture Cash Episode:- Log in to post comments

Frequently Asked Questions About Cash Collection Management Software

What is Cash Collection Management software?

Cash Collection Management software is a tool that helps in streamlining and optimising the process of collecting payments from customers. It automates the accounts receivable (AR) process, from invoicing to payment follow-ups. making it easier for businesses to manage their cash flow effectively.

This software typically includes features such as automated invoice reminders, payment tracking, customer account management, and reporting tools. By centralising and automating the cash collection process, businesses can reduce manual efforts, minimise errors, and improve the efficiency of their AR operations.

What are the benefits of using Cash Collection Management software?

Using Cash Collection Management software offers several benefits, including:

- Improving cash flow through faster payment collections

- Reducing administrative costs

- Minimising risk of bad debt

- Enhancing customer relationships by providing clear, consistent communication and flexible payment options

- Providing valuable insights into customer payment behaviours

- Freeing up time for finance teams to focus on strategic activities

What factors should I consider when choosing an AR Collection software?

When choosing AR Collections software, consider its integration capabilities with your existing accounting or ERP systems, its ability to scale with your business, and the availability of customer support. Evaluate the software’s features, such as automated reminders, payment tracking, reporting tools, and customer communication capabilities. Moreover, make sure it is user-friendly for both your team and your customers.

And most importantly, assess the software’s security measures to protect sensitive financial data. That way, your business can strengthen its trust with customers.

Does the software offer features for international collections?

Yes, Esker’s Cash Collection Management software options offer features tailored for international collections. This includes multi-currency support, language customisation, and compliance with various international financial regulations. With these features, businesses can manage collections efficiently across different countries, accommodating the diverse needs of global customers and navigating the complexities of international trade.

Can Esker AR Collection software leverage AI to predict potential payment delays and personalise collection strategies?

Yes, it can! Esker’s AR Collection software leverages artificial intelligence (AI) to predict potential payment delays and personalise collection strategies. AI algorithms analyse historical payment data to identify trends and behaviours, allowing businesses to proactively address issues and tailor their approach to each customer. This predictive capability can significantly improve the effectiveness of collection efforts, reduce the time to collect, and enhance customer relationships by offering targeted, timely solutions.

Can the Cash Collection Management software help me create dynamic payment plans and negotiate flexible terms with customers?

Yes, Esker’s Cash Collection Management software can help businesses create dynamic payment plans and negotiate flexible terms with customers. The software allows for the customisation of payment terms based on individual customer needs or situations, facilitating negotiations directly through the platform. This flexibility can improve customer satisfaction and loyalty, while also ensuring more predictable cash flow for the business. By offering tailored payment solutions, businesses can effectively manage risk and maintain a healthy balance sheet.

Frequently Asked Questions About Cash Collection Management Software in Singapore

Does Esker Singapore’s Cash Collection Management software support PeSIT and UBL formats for e-invoicing compliance in Singapore?

Yes, Esker Singapore’s Cash Collection Management software is able to support PeSIT and UBL formats, aligning with Singapore’s e-invoicing standards and ensuring compliance with local regulations. This capability allows businesses to efficiently process and manage invoices, facilitating seamless e-invoicing transactions that meet the requirements of Singapore's nationwide e-invoicing network. By accommodating these formats, Esker's software streamlines the invoicing and collections process, enhancing operational efficiency and compliance.

How does the AR Collection software ensure adherence to the Personal Data Protection Act (PDPA) and other relevant regulations in Singapore?

Built with stringent security measures, Esker’s AR Collection software ensures full adherence to the Personal Data Protection Act (PDPA) and other relevant regulations in Singapore. It incorporates data encryption, access controls, and audit trails to protect sensitive customer information.

Moreover, the software is regularly updated to comply with evolving legal requirements. That way, businesses have the assurance that their collections processes are efficient and fully compliant with Singapore’s data protection standards.

Does the Debt Management software offer features specifically relevant to managing collections in my industry (e.g., F&B, retail, logistics) in Singapore?

Yes, Esker’s Debt Management software offers customisable features that can be tailored to meet the specific needs of various industries, such as F&B, retail, and logistics, in Singapore. It includes industry-relevant templates, workflows, and reporting tools that address the unique challenges and requirements of collections management in these sectors. This flexibility ensures that businesses can optimise their collections strategies, improve customer communications, and enhance cash flow, regardless of their industry.

Can the AR collection software integrate with popular payment gateways used in Singapore, like GrabPay and PayNow?

Yes, Esker’s AR collection software can integrate with popular payment gateways used in Singapore, such as GrabPay and PayNow. As such, businesses can provide convenient and secure payment options for customers, streamlining the collections process and improving the customer experience. By offering a variety of payment methods, businesses can accelerate the collections process, reduce payment delays, and enhance overall efficiency.

How can the software help me manage collections related to recurring subscriptions, common in the Singaporean business landscape?

Esker’s Cash Collection Management software is adept at managing collections related to recurring subscriptions, which is a common business model in the Singaporean market. It can automate invoice generation, send timely payment reminders, and track payment statuses for subscription-based services, ensuring consistent cash flow. Overall, the software’s ability to handle recurring billing cycles and manage subscriber data simplifies the complexities associated with subscription management, enhancing customer satisfaction and loyalty.

Can the software integrate with open banking solutions like SingPass MyInfo for smoother authentication and secure payments?

Yes, it can. Businesses interested in integrating open banking solutions, like SingPass MyInfo into Esker’s AR Collections software should inquire directly with Esker. While Esker’s software is designed to integrate with a variety of systems, direct integration with open banking solutions like SingPass MyInfo for authentication and secure payments would depend on the specific capabilities and updates of the software.

Frequently Asked Questions About Cash Collection Management Software in Malaysia

Does Esker Malaysia’s Cash Collection Management software comply with PeSIT and UBL e-invoicing formats and adhere to potential future e-invoicing mandates in Malaysia?

Yes, Esker Malaysia's Cash Collection Management software can accommodate PeSIT and UBL e-invoicing formats. This ensures compliance with current e-invoicing standards and preparedness for any future mandates in Malaysia. By staying ahead of e-invoicing requirements, Esker’s software helps businesses streamline their invoicing processes, ensuring they can easily adapt to regulatory changes without disrupting their operations.

How does the Debt Management software ensure compliance with the Personal Data Protection Act (PDPA) and other relevant Malaysian regulations, like Bumiputera Economic Cooperation Act (BECM)?

Esker’s Debt Management software adheres to the Personal Data Protection Act (PDPA) and incorporates considerations for the Bumiputera Economic Cooperation Act (BECM) in Malaysia. It ensures data security and privacy through encryption, access controls, and audit trails, maintaining compliance with PDPA. Additionally, it provides functionality to manage and report on Bumiputera-related procurement activities, supporting businesses in adhering to BECM requirements.

Can the Debt Collection software integrate with popular payment gateways in Malaysia, like DuitNow Pay or Maybank2U e-Wallet?

Definitely. Businesses can integrate Esker’s Debt Collection software with popular Malaysian payment gateways like DuitNow and Maybank2U e-Wallet. This integration enables businesses to offer multiple payment options, facilitating easier and more convenient payment processes for customers. By accommodating local payment preferences, the software enhances the customer experience, potentially reducing payment delays and improving cash flow.

How can the Cash Collection Management software help manage collections for micro, small, and medium enterprises (MSMEs), prevalent in the Malaysian economy?

With Esker's Cash Collection Management software, businesses can automate invoicing and collection processes, reducing administrative burdens and enabling MSMEs to focus on growth. Moreover the software also provides valuable insights into payment behaviours, helping these businesses tailor their collection strategies to improve cash flow and financial stability in a competitive market.

Does Esker Malaysia’s Cash Collection Management software leverage AI or machine learning to predict payment delays and personalise collection strategies based on Malaysia's economic landscape?

Yes, the software incorporates AI and machine learning to predict payment delays and personalise collection strategies, taking into account Malaysia's unique economic landscape. By analysing historical payment data, it identifies patterns and trends, enabling businesses to proactively address potential issues and tailor their approach to individual customers. This helps in improving the effectiveness of collections and supports a more strategic approach to cash flow management.

Does the Debt Management software offer features for managing collections related to the Sharia-compliant financial sector in Malaysia?

Absolutely. Esker’s software offers functionalities that can be adapted to manage collections related to the Sharia-compliant financial sector in Malaysia. While specific Sharia-compliant features would depend on the latest software updates and customisations, the flexibility of Esker’s platform allows for the development of collection processes that align with Islamic finance principles. Feel free to reach out to Esker to learn how to adapt the software to manage these types of collections.

Does the AR Collections software include a built-in multilingual tool for users to switch to different languages?

Yes, it does. Esker's software includes a built-in multilingual tool, enabling users to switch between different languages, enhancing usability across diverse linguistic groups. This feature is particularly beneficial in Malaysia, where businesses operate in a multilingual environment. Overall, this feature promotes clearer communication with customers and suppliers, improving the efficiency and effectiveness of the collection process.

Our partners

- Coming Soon