Source-to-Pay Software

Empower your Office of the CFO with AI solutions built to drive better financial results and insight into the entire buying process.

Transform the way you source, purchase, book & pay

The era of disconnected finance and procurement functions is over. With Esker’s AI-driven Source-to-Pay software suite, procurement processes are streamlined, policy compliance is effortlessly enforced, and supplier relationships have never been better.

Esker’s integrated Source-to-Pay solutions:

Sourcing

Ensure the best price for goods and services via RFPs or e-auctions.

Supplier Management

Monitor risks and simplify onboarding all from one centralised location.

Contract Management

Manage new and existing contracts with ease from a single digital repository.

Procurement

Transform buying into a consumer-friendly, Amazon-like experience.

Accounts Payable

Stay compliant while reducing invoicing costs and processing delays.

Expenses

Automate low-value tasks while helping employees get reimbursed quickly.

Payment & Supply Chain Financing

Automate payment approval workflow while securing discounts and supporting suppliers that need cash.

S2P benefits that support your team & strengthen your business

Improve Process Efficiency

Automate manual tasks, eliminate errors and speed up procurement activities by reducing the time and effort required to manage procurement and payable processes.

Enhance supplier management

Centralise supplier contracts and data, and facilitate onboarding with Esker’s Source-to-Pay automation. Improve supplier performance, negotiate better pricing and terms, and manage compliance with ESG standards to improve supply chain sustainability.

Increase Savings

Achieve cost savings through better supplier management, improved spend insights to negotiate better prices and optimised sourcing processes or payment terms.

Better Spend Insights

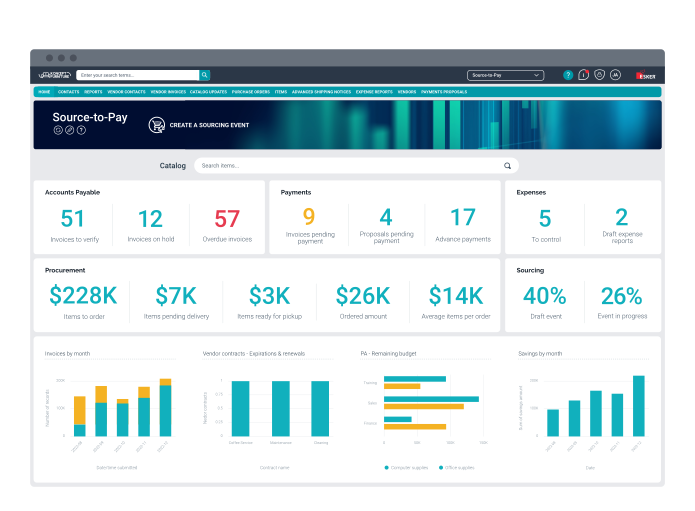

Get real-time visibility into procurement spend to make informed decisions regarding procurement activities, including spend by category, supplier performance and contract compliance.

See what the experts say

Esker’s Source-to-Pay solutions have been recognised by multiple leading analyst firms over the years. Most recently, these include:

Esker named a Challenger in the 2025 Gartner® Magic Quadrant™ Report for Source-to-Pay Suites

Esker named a Leader in the IDC MarketScape: Worldwide AP Automation Software 2024 Vendor Assessment in both Large Enterprise and Midmarket.

Esker was recognised as a Market Leader in Ardent Partners' 2023 ePayables Technology Advisor for the third consecutive time.

Esker named a Leader in The Forrester Wave™: Accounts Payable Invoice Automation, Q3 2024

Why automate S2P with Esker?

Esker’s Source-to-Pay suite offers a complete, all-in-one solution to overcome the most significant challenges facing today’s Procurement and Finance leaders. Our S2P system delivers a number of competitive advantages, including:

Seamless Integration

Designed to ensure compatibility throughout the S2P cycle, Esker's suite streamlines processes, increases efficiency and provides one centralised data source across all solutions.

Greater Scalability

Thanks to the software’s ability to scale across different solutions, processes and geographies over time, users don't have to make all the decisions for future scenarios at the moment of purchase.

Enhanced Experience

Esker delivers a consistent UX across all solutions, reducing the need for training and increasing adoption rates while solidifying user retention, reducing errors and improving usability.

Lowered TCO

A centralised suite is more cost-effective, as it eliminates the need for multiple vendors and associated integration costs and increases productivity (i.e., no switching back and forth between programmes).

See what our customers say on Gartner Peer Insights

FREQUENTLY ASKED QUESTIONS ABOUT SOURCE-TO-PAY SOFTWARE

What is Source-to-Pay software?

Source-to-Pay software is an integrated platform that streamlines and automates the entire procurement cycle, from sourcing vendors to making payments. It provides end-to-end visibility into procurement operations, supporting strategic decision-making, improving efficiency, and reducing costs. The software provides smart procurement solutions tailored to the unique needs of different industries and geographies.

To better illustrate how our Source-to-Pay automation software can help businesses, our partnership with Sunway Group can be your basis. Faced with challenges such as data entry errors, lost documents, prolonged invoice processing times, and an overwhelmed staff, Sunway turned to Esker Singapore's Source-to-Pay software. The Source-to-Pay platform helped digitise and automate invoice processing, reducing errors and accelerating approvals. This led to faster supplier payments, minimised manual interventions, and boosted staff morale. Read the full Sunway success story.

What are the key benefits of implementing Source-to-Pay software?

Implementing Source-to-Pay software offers businesses a myriad of benefits. It ensures comprehensive procurement transparency, enabling better decision-making. The platform streamlines and automates workflows, reducing manual tasks and potential errors. This leads to significant cost savings, both in terms of operational expenses and through better vendor negotiations.

Being a leader in this field, Esker Singapore has been recognised as a Sample Vendor in three categories of the 2023 Gartner® Hype Cycle™ for Procurement and Sourcing Solutions, underscoring its commitment to delivering top-tier solutions. Learn more about Esker Singapore's listing as a sample vendor.

How does Source-to-Pay software facilitate compliance with ESG standards?

Source-to-Pay software aids in maintaining compliance with Environmental, Social, and Governance (ESG) standards by providing visibility into the supply chain. It allows businesses to track vendor performance against ESG criteria, ensuring suppliers align with the company's sustainability goals. The software also documents all transactions, supporting audit trails and proving compliance.

In a real-world application, Logitech, a global computer peripherals and software manufacturer, faced challenges in closely managing its supply chain amidst the rising demand for rapid technological innovation.

By integrating the Source-to-Pay automation software by Market Dojo, a company under Esker, they were able to manage global compliance tenders efficiently. These tenders, which were previously managed manually using spreadsheets and emails, became streamlined, reducing time and complexity. The platform allowed Logitech to reach out to agents worldwide, ensuring their products met compliance standards across various countries. This not only optimised their internal operations but also resulted in significant cost savings, as evidenced by a compliance tender that led to a £300 thousand saving. Delve into the full Logitech story for more details.

Does the Source-to-Pay suite offer integration with existing ERP systems?

Yes. Esker’s comprehensive Source-to-Pay suite can integrate with existing Enterprise Resource Planning (ERP) systems to streamline data exchange and reduce errors and duplications. The platform allows for a unified view of data in our procurement management system, ensuring smooth and efficient operations across the business. Additionally, the Source-to-Pay software integrates with our electronic invoicing (e-invoicing) solution, automatically matching purchase orders and ensuring that payments are made promptly and discrepancies are quickly identified and resolved. These integrations speed up the order and payment process, building trust and reliability between suppliers and buyers.

Can Source-to-Pay software handle different procurement processes and geographies?

Absolutely! Esker’s Source-to-Pay platform is designed to manage diverse procurement processes across different geographies. It can adapt to local procurement regulations and currencies, making it a powerful tool for global businesses. Its flexibility also allows it to accommodate the unique requirements of various industries and procurement models.

How does the Source-to-Pay suite support scalability for future scenarios?

Made with scalability in mind, Esker’s Source-to-Pay software can easily expand to accommodate more users, suppliers, and transactions as businesses grow and procurement needs evolve. With its cloud-based nature, businesses can ensure smooth scaling, making it a future-ready solution for growing enterprises.

What insights and analytics does Source-to-Pay software provide for better decision-making?

Esker’s Source-to-Pay platform offers comprehensive analytics and insights for improved decision-making. It tracks key performance indicators (KPIs), such as spend analysis, supplier performance, and contract compliance. These real-time insights, derived from data across the procurement cycle, equip businesses with actionable intelligence to streamline operations, mitigate risks, and uncover cost-saving opportunities.

How does the software ensure compliance with data privacy regulations (e.g., GDPR, CCPA)?

The S2P software is compliant with relevant data privacy regulations by implementing robust data protection measures. This includes encryption of data in transit and at rest, regular privacy audits, and ensuring that data collection and processing practices meet legal requirements. Moreover, users have the right to access, rectify, or erase their personal data, providing transparency and giving them control over their personal information.

Do I have control over who can access and share my procurement data?

Yes, you can maintain complete control over who can access and share your procurement data within the Source-to-Pay software. Access control mechanisms and permission settings allow you to specify which individuals or roles can view, edit, or share your procurement information. These settings help ensure that sensitive data is only accessible to authorised personnel, enhancing data security and integrity within your organisation.

FREQUENTLY ASKED QUESTIONS ABOUT SOURCE-TO-PAY SOFTWARE IN SINGAPORE

What are the benefits of using Source-to-Pay software in Singapore?

Using Source-to-Pay software in Singapore streamlines procurement and financial processes, offering greater efficiency, improved compliance with regulatory standards, and enhanced visibility across the entire procurement cycle. It reduces manual tasks, mitigates risk by ensuring compliance with local laws, and optimises spending through better supplier negotiations and cost management. With S2P software, organisations can enhance their operations, have better financial control, and gain strategic sourcing insights, contributing to significant cost savings and operational excellence.

What features are essential for Source-to-Pay software in Singapore?

When planning to use Source-to-Pay software to maximise operations for your business in Singapore, it should include the following:

- Comprehensive procurement management

- Contract management

- Supplier management

- Spend analysis

- Invoicing features.

- Integration capabilities with local financial systems

- Support for SGD compliance with Goods and Services Tax (GST) regulations

- Robust security measures to protect sensitive data

- User-friendly interfaces

- Customisable workflows that adapt to local business practices

What factors should I consider when choosing a Source-to-Pay software?

When selecting a Source-to-Pay software, consider its ability to integrate with existing systems, compliance with local and international regulations, and scalability to grow with your business. Moreover, assess the software's features against your company’s specific procurement needs, and ensure it offers robust analytics and reporting tools. You should also consider vendor support and the overall cost of ownership.

Does the software comply with local procurement regulations and standards?

Yes, Esker’s Source-to-Pay software complies with Singapore's local procurement regulations and standards. This ensures that organisations can manage procurement activities with transparency and in accordance with the law. Moreover, our S2P platform adheres to the Public Sector Procurement Regulations and any industry-specific compliance requirements, thereby minimising legal risks and fostering trust with stakeholders.

Does the software support Goods and Services Tax (GST) regulations?

Definitely, Esker’s S2P software is designed to support Goods and Services Tax (GST) regulations. That way, businesses in Singapore can automatically calculate and apply GST to procurement transactions. This feature simplifies tax reporting and compliance, ensuring that businesses can accurately manage and report their tax obligations in line with local laws.

How can I ensure successful software implementation in Singapore?

To successfully integrate Esker’s Source-to-Pay software, proper planning is crucial. When planning, it is essential for organisations to set objectives and engage stakeholders to implement the system in a way that enhances their operational efficiency. Moreover, they should provide proper training and support for users; that way, employees can adapt to the process of using the software and maximise its features.

Regular communication, pilot testing, and feedback collection can also help in adjusting the implementation process for better outcomes.

Are there any government grants or incentives available for adopting Source-to-Pay software?

Yes, there are! Singapore offers various government grants and incentives for businesses looking to adopt digital solutions like Source-to-Pay software. One of the programmes businesses, especially small and medium-sized businesses (SMEs), can look into is the Productivity Solutions Grant (PSG). This grant provides financial assistance to SMEs for adopting IT solutions and equipment that improve business processes, including procurement.

For more information on available grants, you can also check the latest offerings from the Infocomm Media Development Authority (IMDA) and Enterprise Singapore.

FREQUENTLY ASKED QUESTIONS ABOUT SOURCE-TO-PAY SOFTWARE IN MALAYSIA

What are the benefits of using Source-to-Pay software in Malaysia?

In Malaysia, Source-to-Pay software enhances procurement efficiency, streamlines operations, and improves compliance with local regulations. Businesses benefit from automated processes that reduce manual errors, strategic sourcing that optimises costs, and real-time analytics for informed decision-making.

By integrating this software into their day-to-day operations, businesses can promote strong supplier relationships. Moreover, they can ensure adherence to Malaysia's procurement guidelines, offering a holistic approach to managing expenditures and maximising profitability.

What are the essential features of Source-to-Pay software in Malaysia?

Malaysian businesses should consider S2P software features like multi-currency support, compliance with Malaysian Goods and Services Tax (GST), and integration with local financial systems. Robust reporting and analytics, electronic invoicing, and procurement and supplier management functionalities are critical. The software should also support local e-invoice formats for seamless transactions with government and private entities.

What factors should I consider when choosing Source-to-Pay software?

Key considerations to have when choosing an S2P software include software scalability, customisation options, ease of integration with existing systems, and compliance with local and international standards. Assess the software’s ability to handle local tax regulations, its support for preferred e-invoice formats, and its capability to provide real-time analytics and reporting.

Other factors to consider are vendor reputation, customer support, and total cost of ownership.

Does the software comply with Malaysian accounting standards and regulations?

Yes, Esker’s Source-to-Pay software complies with Malaysian accounting standards and regulations, ensuring accurate financial reporting and adherence to local compliance requirements. This includes support for Malaysia's specific tax laws, accounting practices, and business transaction standards, facilitating a smooth and compliant procurement process.

Does the software support PeSIT and UBL e-invoice formats for seamless compliance?

Definitely! Esker’s quality Source-to-Pay software supports PeSIT and UBL e-invoice formats, which is crucial for seamless compliance with Malaysian and international e-invoicing standards. This also ensures that businesses can easily exchange invoices with government bodies and international partners, streamlining the invoicing process and improving efficiency.

How does the software handle Goods and Services Tax (GST)?

Esker’s Source-to-Pay software can manage Goods and Services Tax (GST) by automating tax calculations, ensuring accurate GST filing, and maintaining compliance with Malaysian tax regulations. This feature simplifies the process of applying the correct tax rates to procurement transactions, facilitating accurate and compliant tax reporting.

What support options are available in Malaysia?

When adopting Esker's Source-to-Pay software, Malaysian businesses can benefit from a range of support options designed to ensure a smooth transition and proficient use of the platform. Online support from Esker's dedicated team is readily available to address technical issues, provide guidance, and offer solutions to any challenges that may arise. Additionally, users have access to a comprehensive knowledge base, packed with tutorials, FAQs, and best practices, aimed at helping them master the software's features and functionalities.

Will the software integrate with popular Malaysian accounting software (e.g., MYOB AccountEdge)?

Absolutely. Esker’s Source-to-Pay software solutions are designed to integrate with popular Malaysian accounting software, such as MYOB AccountEdge, to enhance workflow efficiency and data accuracy. With this, companies in Malaysia can experience seamless data exchange between procurement and accounting systems, streamlining financial management processes.

Our partners

- Coming Soon