Title

What is Accounts Payable in Accounting?

What is Accounts Payable in Accounting?

Accounts payable (AP), often referred to as payables, is a critical function within any business. It involves managing and tracking the money your company owes to its suppliers and vendors for goods and services received. While it might seem like a behind-the-scenes process, efficient AP is essential for maintaining strong supplier relationships, optimising cash flow, proper internal communications and ensuring accurate financial reporting.

The Challenges of Traditional Accounts Payable

Traditional AP processes often rely on manual methods, leading to several challenges:

- Time-Consuming: Manual data entry, invoice processing, and reconciliation can be extremely time-consuming, especially for businesses with high invoice volumes.

- Prone to Errors: Human error is a significant risk with manual processes, leading to inaccurate records, late payments, and potential disputes with suppliers.

- Lack of Visibility: Manual processes often lack real-time visibility into invoice status, payment deadlines, and supplier relationships, hindering informed decision-making.

- Limited Scalability: Manual methods become increasingly inefficient and error-prone as businesses grow and invoice volumes increase.

Accounts Payable Automation: The Solution to better Efficiency

Accounts payable automation is the process of using software to automate tasks related to AP, such as invoice capture, data entry, approval routing, payment processing, and reconciliation. This automation can significantly improve efficiency, accuracy, and visibility within your AP function.

Benefits of Finance Automation for Accounts Payable

AP automation software is designed to streamline your AP processes, eliminating manual tasks and reducing errors. These solutions typically offer features like:

- Automated Invoice Capture: AI-powered tools capture and extract data from invoices, eliminating manual data entry and reducing errors.

- Workflow Automation: Streamline invoice approval processes with automated routing and notifications, ensuring timely approvals and reducing bottlenecks.

- Automated Payment Processing: Generate and send payments electronically, reducing manual effort, improving accuracy, and accelerating payment cycles.

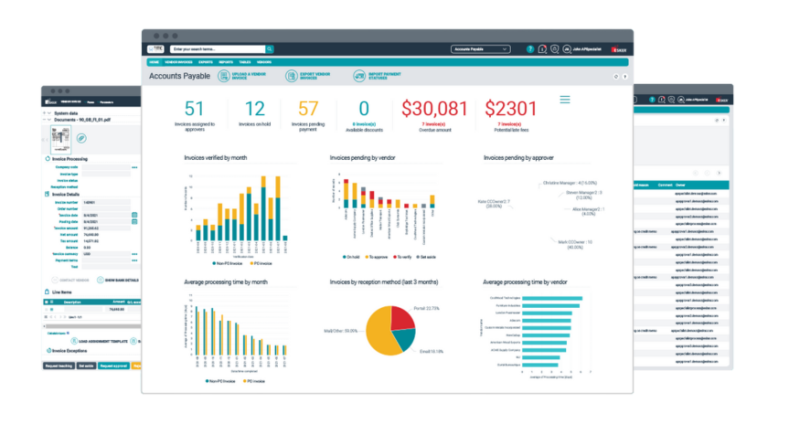

- Real-Time Visibility: Gain instant access to invoice status, payment deadlines, and supplier relationships through intuitive dashboards, enabling proactive management and informed decision-making.

Beyond Accounts Payable: The Importance of Accounts Receivable

While this blog post focuses on accounts payable, it's important to remember that accounts receivable and accounts payable are two sides of the same coin. While AP focuses on managing your company's obligations to suppliers, accounts receivable (AR) focuses on managing the money owed to your company by its customers. Effective management of both AP and AR is crucial for maintaining a healthy financial position.

Ready to Transform Your AP Function?

Esker's Source-to-Pay solution empowers you to transform your AP function, achieving greater efficiency, accuracy, and control. Contact Esker today to learn how their innovative solutions can help your business thrive in the digital age.