Title

GST InvoiceNow: Your Essential Guide to E-invoicing Compliance in Singapore

In the realm of business operations, staying abreast of regulatory requirements is paramount. In Singapore, the implementation of GST InvoiceNow by the Inland Revenue Authority (IRAS) represents a significant milestone in the digitisation of invoicing processes.

On 15 April 2024, the Inland Revenue Authority of Singapore (IRAS) and Infocomm Media Development Authority (IMDA), also Singapore Peppol Authority) announced guidelines for businesses to adoption of B2B e-invoices through InvoiceNow (“GST InvoiceNow Requirement”)

Understanding GST InvoiceNow

GST InvoiceNow is an initiative introduced by IRAS to encourage the adoption of electronic invoicing among businesses in Singapore. The mandate requires businesses to electronically issue and receive invoices in a structured digital format, facilitating smoother transactions and reducing administrative burdens.

Implementation Timeline

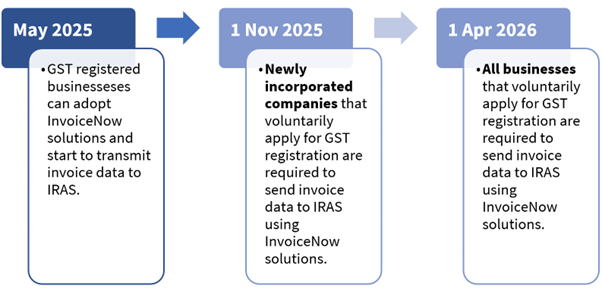

To aid businesses in the transition to electronic invoicing, IRAS has outlined a phased approach for compliance:

Source: IRAS

- 1 May 2025: Soft launch. GST-registered businesses can voluntarily adopt GST InvoiceNow Requirement;

- 1 November 2025: Newly incorporated companies[1]that voluntarily register for GST;

- 1 April 2026: All new voluntary GST-registered, regardless of incorporation date.

Guidelines for Compliance

To comply with GST InvoiceNow, businesses must adhere to the following guidelines:

- Use of Peppol Network: Invoices must be transmitted via the Peppol e-invoicing network, which ensures secure and standardised exchange of electronic documents.

- Businesses under the GST InvoiceNow Requirement are required to transmit to IRAS invoice data relating to the following transactions:

- Standard-rated supplies

- Zero-rated supplies

- Standard-rated purchases on which input tax claims are made or will be made

For point-of-sale supplies data and petty cash purchases data, businesses can choose to aggregate the transactions before transmitting to IRAS.

Benefits of going onboard with InvoiceNow

- Streamlined processes: InvoiceNow solution enables direct transmission of e-invoices in a structured data format across different finance systems, thereby eliminating manual work involved in the sending, receipting and recording of invoices into systems.

- Reduced errors and costs: InvoiceNow solution reduces manual processes, along with errors and rectification costs. With invoice records maintained electronically, it also reduces invoice storage and retrieval costs.

- Improved cashflow management: InvoiceNow facilitates quicker invoice processing and payment, helping businesses to more effectively manage their cashflow.

- Eliminate manual efforts for submissions to IRAS and paper work

- Faster Processing: Enjoy faster GST refunds

- Get Visibility: Receive alerts for wrongful GST charges from non-GST registered suppliers

How Esker Can Help

As an established leader in document automation and e-invoicing solutions, Esker is uniquely positioned to assist businesses in their journey towards GST InvoiceNow compliance. Here's how Esker can help:

- Access Point Provider: Esker serves as your trusted Access Point Provider, facilitating the seamless transmission of e-invoices to the Peppol network.

- E-invoice compliance: One Global Solution in 60+ Countries. Learn more here.

- Comprehensive Solutions: Esker offers a comprehensive suite of solutions tailored to meet the diverse needs of businesses, including e-invoicing, end-to-end source to Pay, Accounts Payable, Accounts Receivable & Order management solutions.

- Expert Guidance: With Esker's expertise and guidance, businesses can navigate the complexities of GST InvoiceNow with confidence, ensuring smooth compliance and operational efficiency.

The Importance of Choosing the Right Access Point Provider. Why Esker?

While complying with GST InvoiceNow is essential, choosing the right Access Point Provider is equally crucial. An Access Point Provider acts as an intermediary between businesses, ensuring seamless transmission of e-invoices to the Peppol e-invoicing network, which facilitates secure and standardised exchange of electronic documents.

- IMDA Approved Acess Point Solution Provider: Esker's recognition by IMDA reaffirms its commitment to compliance and excellence in providing e-invoicing solutions. By choosing Esker as your Access Point Provider, you can rest assured that you're partnering with a trusted and reputable company endorsed by regulatory authorities.

- Comprehensive Solutions: Esker offers a comprehensive suite of solutions tailored to meet the diverse needs of businesses, including e-invoicing, end-to-end Source-to-Pay, Accounts Payable, Accounts Receivable & Order management solutions.

- Seamless Integration: Integrating Esker's solutions into your existing systems is seamless and hassle-free. Whether you're using ERP software, accounting platforms, or other business applications, Esker ensures compatibility and smooth integration, minimising disruption to your workflow.

- Enhanced Efficiency: By digitising and automating manual processes, Esker helps businesses eliminate inefficiencies, reduce errors, and accelerate cycle times. With real-time visibility into invoice status and automated validation checks, Esker empowers businesses to achieve greater operational efficiency and cost savings.

- Scalability and Flexibility: Whether you're a small startup or a large enterprise, Esker's solutions are scalable to accommodate your evolving needs. With flexible deployment options, customisable workflows, and on-demand access to insights and analytics, Esker enables businesses to adapt and thrive in a dynamic marketplace.

Conclusion

As the deadline for GST InvoiceNow compliance approaches, businesses must act swiftly to ensure readiness and adherence to regulatory requirements. With Esker as your partner, you can navigate this transition seamlessly, unlocking the benefits of electronic invoicing while streamlining your business operations.

Don't wait until the last minute. Embrace the future of invoicing with Esker and embark on a journey towards enhanced efficiency, compliance, and business success. Contact us today to learn more about how Esker can support your GST InvoiceNow compliance efforts.